Disclosure: As an Amazon Associate I earn from qualifying purchases. This page may contain affiliate links, which means I may receive a commission if you click a link and purchase something that I have recommended. There is no additional cost to you whatsoever.

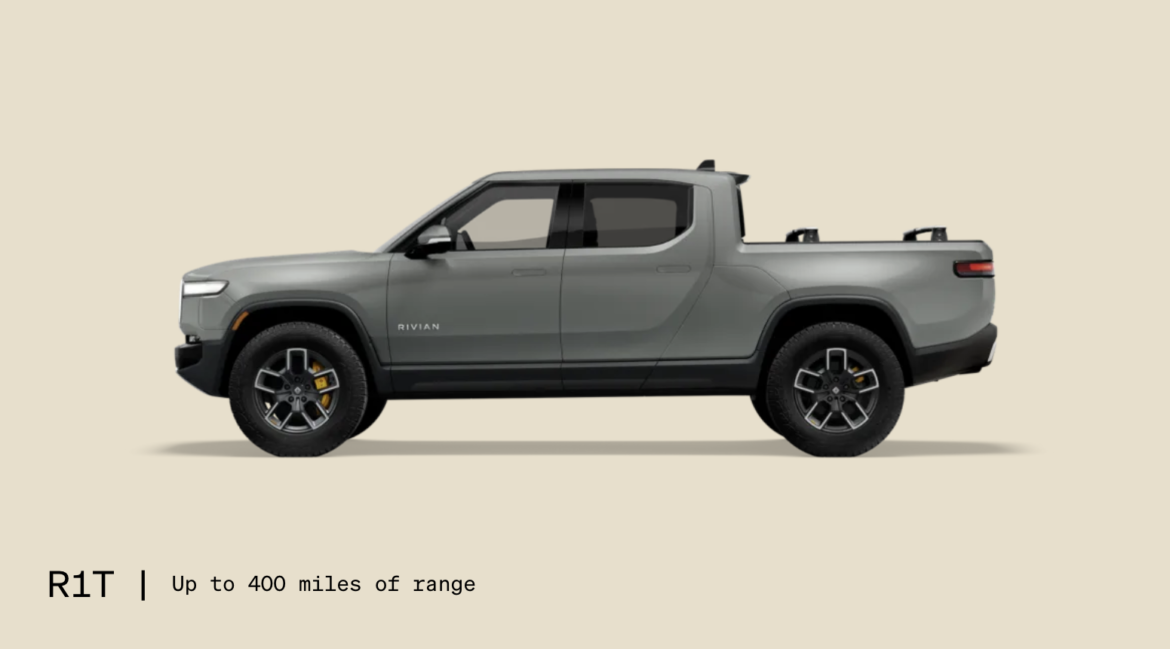

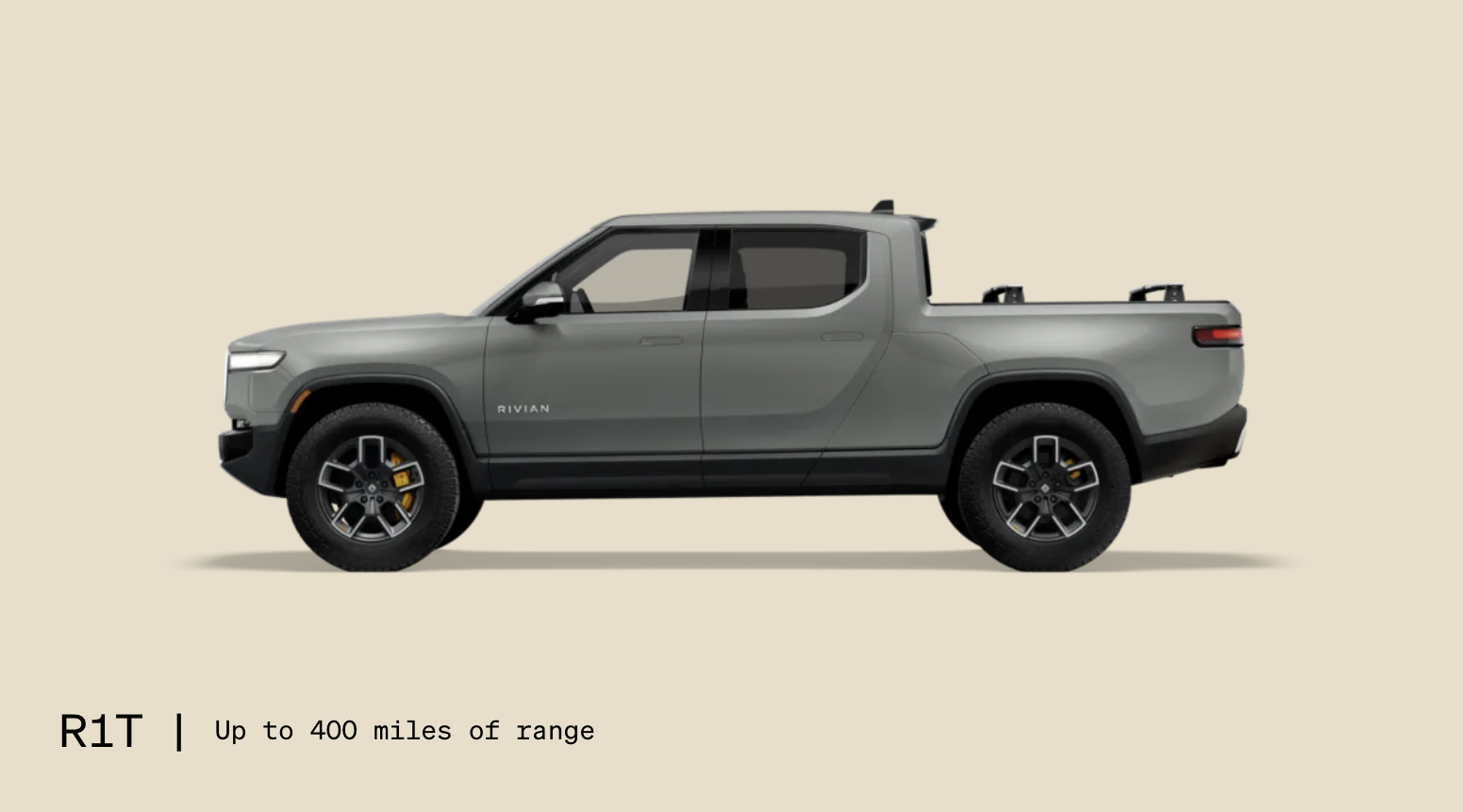

Electric automobiles might be saving 1000’s on gasoline. But anticipate extra to insure them. This is a Rivian electrical truck.

With considerations in regards to the sustainability of fossil fuels rising and a rising pattern towards “greener” applied sciences, electrical autos (EVs) have edged additional into the forefront. The potential benefits of EVs are numerous –however if you happen to’re contemplating making your subsequent automobile buy an EV, you must know chances are you’ll find yourself paying extra in insurance coverage premiums. We’ll delve into why precisely that is and what you are able to do about it.

Benefits of Driving an Electric Vehicle

First, let’s take a fast have a look at the perks of going electrical, significantly people who may offset the extra insurance coverage prices.

The most important benefit in terms of cash is gasoline effectivity: electrical automobiles are way more fuel-efficient than their gasoline-burning counterparts. Even when the consumption rate fails to meet the promises of car manufacturers, the numbers are nonetheless considerably higher than these of a gas-burning engine. Better power effectivity means decrease gasoline payments.

Electric autos additionally are inclined to have a decrease upkeep value than extra conventional autos. They have fewer elements which are susceptible to put on and tear, decreasing the frequency of obligatory repairs. The regenerative braking systems current in lots of EVs lengthen the lifespan of the automotive’s brake pads, additional bringing down upkeep prices.

Tax incentives and insurance coverage reductions are different good causes to put money into an electrical automobile. Many insurance coverage corporations provide reductions for inexperienced autos, together with EVs and hybrids. The authorities has additionally been identified to offer tax incentives as a way to additional encourage the adoption of extra energy-efficient autos.

Finally — and that is the draw for a lot of EV fanatics — there’s the private satisfaction of creating rather less of an impression on the surroundings. The ecologically good automobile doesn’t exist, and by no means might, however electrical autos are inclined to make a a lot smaller unfavourable impression on the world.

Why Are EVs More Expensive to Insure?

Lucid electrical

But if EVs are cheaper to keep up, how can they be costlier to insure? A few causes.

First, insurance coverage for electrical autos is topic to the identical vary of standards as their conventional counterparts: your age, driving and claims historical past, marital standing, and even your credit score rating and ZIP code could make a distinction in how a lot you’ll pay for auto insurance coverage.

Secondly, whereas the components on EVs are typically longer-lasting and break much less incessantly, they’re costlier to switch once they lastly do break. EV batteries are significantly tough and costly to switch. Servicing electrical autos can be costlier basically, since engaged on them requires specialised instruments and coaching that will not be obtainable in every single place.

How To Bring Those Insurance Premiums Down

So how way more does it value to insure an electrical automobile? As you may anticipate, that depends on the vehicle. A Toyota RAV4 Hybrid solely prices about $1700 in yearly premiums — not far off from the nationwide common of $1548. On the opposite hand, insuring an costly high-end automotive just like the Tesla Model X or Porsche Taycan might run you as much as $4000 or extra. Most frequent business EVs will value someplace between $1700 and $2400 to insure yearly. While not essentially a dealbreaker, it’s a important distinction.

Fortunately, there are some methods you possibly can deliver these premiums right down to a degree extra comparable with extra conventional autos. There are the aforementioned tax incentives and insurance coverage reductions obtainable particularly for inexperienced autos. Your present insurance coverage provider might not provide such a reduction, by which case it is likely to be price trying into switching corporations. If you need to go comparability buying, you will get free automotive insurance coverage quotes from quite a lot of on-line instruments — Kristine Lee on the insurance coverage comparability web site The Zebra affords a incessantly up to date information to getting car insurance quotes and discovering a greater deal. Some insurance coverage corporations even specialise in electrical autos.

There are additionally extra time-honored methods of bringing your auto insurance coverage charges down. For instance, you possibly can ask your insurer what sort of different reductions you may qualify for (low mileage, good pupil, occupational or army low cost, multi-vehicle low cost, and many others).

You might additionally put money into some further anti-theft and safety equipment for your vehicle — not a foul concept regardless, provided that EVs are typically a bigger monetary funding total. Insurers will be aware of this and can doubtless provide a reduction for decreasing the chance of a expensive declare. Taking a defensive driving course is one other nice technique to get a reduction. Finally, if you happen to’re a home-owner, think about bundling your private home and auto insurance coverage collectively — most insurers will provide a reduction for that.

While electrical autos at the moment value extra to insure, that will change as they proceed to edge into the mainstream and become more commonplace. The small market share of EVs naturally drives prices up, however as inexperienced options develop into extra widespread and necessary to companies, the insurance coverage charges will doubtless evolve and are available right down to charges just like these of gas-burning autos.