Disclosure: As an Amazon Associate I earn from qualifying purchases. This page may contain affiliate links, which means I may receive a commission if you click a link and purchase something that I have recommended. There is no additional cost to you whatsoever.

Save cash, cut back your carbon footprint, and luxuriate in a house that’s extra snug and wholesome.

The Inflation Reduction Act of 2022 (IRA) is a sweeping piece of laws that represents the largest-ever funding in renewable vitality, vitality effectivity, and electrical autos (EVs) by the U.S. federal authorities. Americans can faucet into quite a lot of new inexperienced vitality and energy-saving incentives to save cash as they decrease their carbon footprint.

The IRA consists of tax credit and different monetary incentives to assist with the price of a renewable vitality system set up, residence vitality upgrades, and energy-efficient home equipment. It additionally consists of EV tax credit that we mentioned in this recent Earth911 guide.

Let’s check out among the incentives that may aid you enhance the vitality effectivity of your house. The following is just not tax recommendation; please seek the advice of a tax skilled to study if you happen to can profit from these energy-related tax credit.

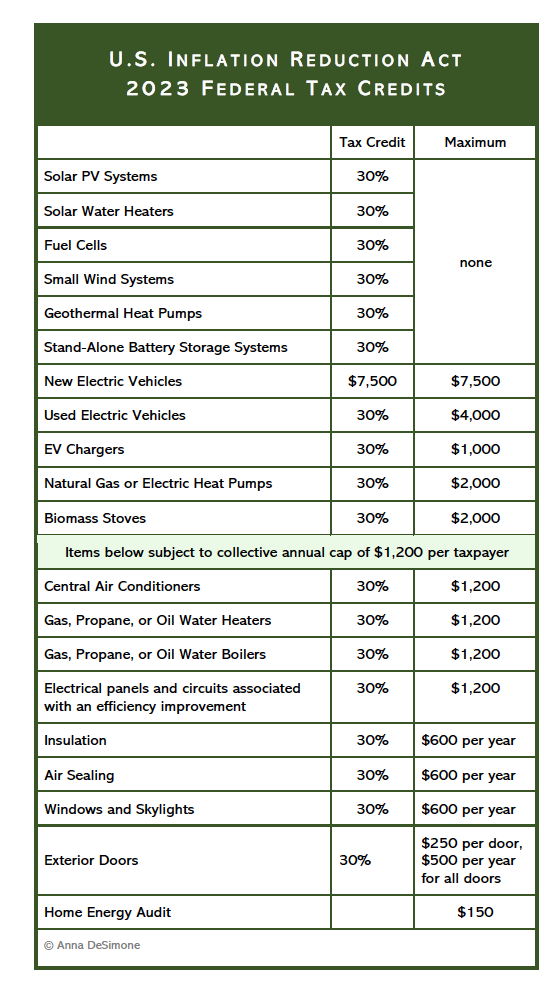

Energy Efficiency & Renewable Energy Federal Tax Credits

The Inflation Reduction Act prolonged the Residential Energy Efficiency Tax Credit and the Residential Renewable Energy Tax Credit by means of 2032. Beginning January 1, 2023, tax credit might be out there on a full vary of HVAC home equipment and energy-efficient merchandise and supplies.

Homeowners who set up eligible renewable energy techniques can obtain tax credit equal to 30% of the full prices, together with labor for on-site preparation, meeting, electrical wiring, inverters, mounting gear, and storage gadgets. For the primary time, federal tax credit might be made out there for standalone vitality storage techniques.

Tax credit are bottom-line, dollar-for-dollar subtractions in your federal 1040 tax return. When you file your annual return, you’ll must itemize every certified buy on IRS Form 5695, Residential Energy Credits. You should take the tax credit the identical yr you buy the eligible objects.

The higher portion of the chart above lists numerous kinds of renewable vitality techniques that qualify for a tax credit score of 30%. There is not any cap on how a lot you spend. Let’s say you spend $30,000 to put in a solar photovoltaic system. By multiplying that quantity by .30 (30%), you may see your taxes are lowered by $9,000. Similarly, if you happen to spend $60,000 on a geothermal energy system, your tax credit score might be $18,000.

The backside portion of the chart lists numerous kinds of home equipment and vitality enhancements. Although this stuff additionally qualify for a 30% tax credit score, quantities are topic to an annual cap of $1,200. As an instance, if you happen to purchase a brand new furnace for $6,000, your 30% tax credit score can be $1,800 — however capped at $1,200. It’s vital to notice, nonetheless, that the cap is per taxpayer. If two of you personal the house, you might recoup a complete of $2,400 per equipment.

Financing Incentives for Home Energy Upgrades

An energy-efficient residence has a decrease true price of homeownership as a result of building supplies are long-lasting, and high-performance home equipment and techniques require fewer repairs and upkeep. There are many kinds of energy-efficient mortgage applications out there from Fannie Mae, Freddie Mac, FHA, VA, and Rural Housing. On such loans, qualifying guidelines are much less strict because of the projected financial savings in utility prices in addition to decrease projected upkeep prices.

Most homebuyers allocate most of their money to the down fee and shutting prices, leaving little cash left to pay for vitality enhancements. However, you may finance the price of vitality enhancements along with your mortgage. Fannie Mae’s Home Style Energy and Freddie Mac’s Green Choice program enable debtors to finance as much as 15% over the price of the house to pay for enhancements.

Let’s say you wish to purchase a house for $200,000, and you’ve got $10,000 (5%) for the down fee. You’d like to finish $20,000 in vitality enhancements. The infographic above reveals how your mortgage will be elevated to cowl the price of enhancements. The vendor receives $200,000, and your lender disburses $20,000 to the contractor. The work will be carried out after you shut on the home. Mortgage approval might be based mostly on the projected enhance in worth as decided by the actual property appraiser. In the state of affairs illustrated, the homebuyer solely wants an extra $1,000 in money.

Your lender will ask you to acquire a written estimate from a licensed contractor (or photo voltaic vitality installer) in addition to an vitality evaluation such because the Home Energy Rating (HERS) from the Residential Energy Services Network (RESNET) or the U.S. Department of Energy’s Better Buildings Home Energy Score.

Energy Upgrades for a Healthier Home

Another advantage of energy-efficient houses: they’re more healthy. A research accomplished by the International Energy Agency (IEA), Capturing the Multiple Benefits of Energy Efficiency, examined well being outcomes ensuing from effectivity measures accomplished by residential owners. They studied a number of measures that have an effect on indoor air quality, together with insulation, air sealing, heating techniques, and air flow. Every sort of enchancment indicated lowered signs of respiratory illness, and air flow measures indicated a lowered danger of most cancers, heart problems, arthritis, and melancholy. Due to scientific developments in air flow techniques, an upgraded system can supply year-round safety for your loved ones by capturing higher ranges of micro organism, allergens, and airborne pollution.

There are a number of HVAC upgrades designed to take away stale air and supply a steady provide of recent, filtered outside air. Whole-house air-filtering systems can defend the house from a broad vary of organic pollution equivalent to mud, dander, pollen, micro organism, mildew, mildew, and viruses. Installed subsequent to your furnace, such techniques are particular to both hot-air or hot-water techniques. Every sort of system may have a high-efficiency filter, equivalent to a HEPA filter. Other kinds of techniques embrace digital and ultraviolet, which may also be inserted into ductwork. If a whole-house system isn’t possible, take into account an Energy Star certified room air purifiers.

Appliances are sometimes licensed with a Maximum Efficiency Reporting Value (MERV) score, which gives an general effectiveness of the equipment on a 16-point scale. Residential residence merchandise usually have a MERV score within the 6 to 12 vary. Energy Star room air cleaners even have a certification known as the Clean Air Delivery Rate (CADR) which measures the quantity of contaminant-free air that’s delivered by the equipment. Find out extra from the Association of Home Appliance Manufacturers.

If you’re looking at new building houses, many builders embrace a certification from the Environmental Protection Agency (EPA) known as Indoor airPLUS. These houses are designed and constructed to reduce publicity to airborne pollution and contaminants, and shield from moisture, mildew, pests, combustion gases, and different pollution. An impartial third celebration should examine the house for compliance with EPA requirements for it to earn airPLUS certification.

Would you wish to study in regards to the new electrical automobile tax credit? Read Understand the Tax Credits Before You Buy a New EV.

About the Author

Anna DeSimone is creator of Live in a Home that Pays You Back, A Complete Guide to Net Zero and Energy-Efficient Homes, that includes a useful resource listing of incentives for every U.S. state and Canadian province.

Anna DeSimone is creator of Live in a Home that Pays You Back, A Complete Guide to Net Zero and Energy-Efficient Homes, that includes a useful resource listing of incentives for every U.S. state and Canadian province.