Disclosure: As an Amazon Associate I earn from qualifying purchases. This page may contain affiliate links, which means I may receive a commission if you click a link and purchase something that I have recommended. There is no additional cost to you whatsoever.

Many of us are conscious that how we spend our cash impacts the world round us. In reality, our client selections are also known as “voting with our greenbacks.” Just as spending cash shapes the world, so does how we make investments cash. Our IRAs, retirement accounts, and faculty financial savings funds have an effect.

Because many individuals make investments their cash in mutual funds or exchange-traded funds (ETFs), it might take a little bit of detective work to determine how the cash is invested. For instance, how have you learnt whether or not a fund invests in one thing that doesn’t align along with your values, similar to fossil gas corporations or pornography?

Here are some recommendations on investing along with your conscience.

Socially Responsible Mutual & ETF Fund Considerations

Socially accountable mutual funds and ETFs have filters that permit investing funds in solely sure corporations or kinds of corporations. For instance, fund managers could exclude tobacco, firearms, playing, alcohol, or pornography.

Today, one in 4 {dollars} beneath skilled administration within the U.S. is invested with socially accountable funding methods, totaling greater than $17.1 trillion. There are many various funding funds on the market, so let’s look at some vital issues.

Investment Funds That Fit Your Values

Socially accountable mutual fund managers generally filter out corporations on account of office practices, firm values, worker variety, environmental considerations, group help, governance points, spiritual values, and human rights practices. Some restrict fossil gas and nuclear energy corporations whereas others don’t. Start by figuring out which components are most important to you when selecting a mutual fund.

Fund Performance

It is a typical false impression that socially accountable mutual funds and ETFs have decrease funding returns. Some traders consider that taking social and environmental considerations under consideration reduces investment risk. Harmful ecological and social practices are liabilities that may create an enormous monetary burden for corporations. However, funds that put money into just one or two sectors could have decrease returns than the S&P 500 and will have a higher threat as a result of they don’t seem to be as numerous.

Expense Ratio

Fundholders are charged an annual share of property for the charges and bills related to working a fund. It is the price of proudly owning a fund, and the costs go in direction of its administration — the decrease the proportion, the decrease the charges.

High charges can hinder returns and are a vital consideration earlier than selecting a socially accountable mutual fund. Typically, the extra actively managed the fund, the upper the expense ratio. This turns into much more necessary over time as a result of the curiosity compounds.

Fund Diversity & Investment Goals

Thankfully, investing with a conscience doesn’t imply abandoning monetary targets. Since socially accountable investing has been round for many years, there are numerous totally different funds to select from with various ranges of threat, fund holdings, minimal purchases, and administration practices.

Alternatives to Mutual Funds: Impact Investment Opportunities

Want to put money into making a distinction? Impact funding alternatives permit traders to help optimistic tasks and initiatives and are a substitute for buying mutual funds. Sample tasks embody preserving urban farmland, selling renewable energy development, and increasing a natural food coop.

In addition, Newday Impact has quite a few portfolios that allow traders to help causes they consider in whereas nonetheless receiving aggressive returns. Its portfolios handle totally different areas of concern, similar to clean water; local weather motion; wildlife conservation and animal welfare; ocean well being; and variety, fairness, and inclusion. The local weather motion portfolio, for instance, contains investments in business leaders in lowering greenhouse fuel emissions; selects investments based mostly on ESG ratings; and contains Tesla and quite a few corporations serving to the transition to renewable energy.

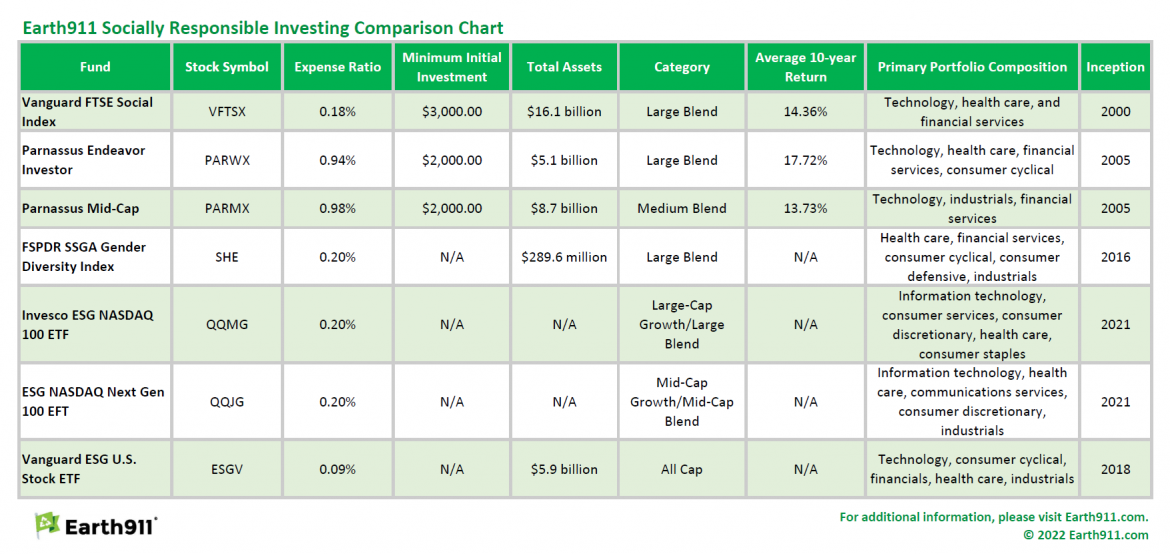

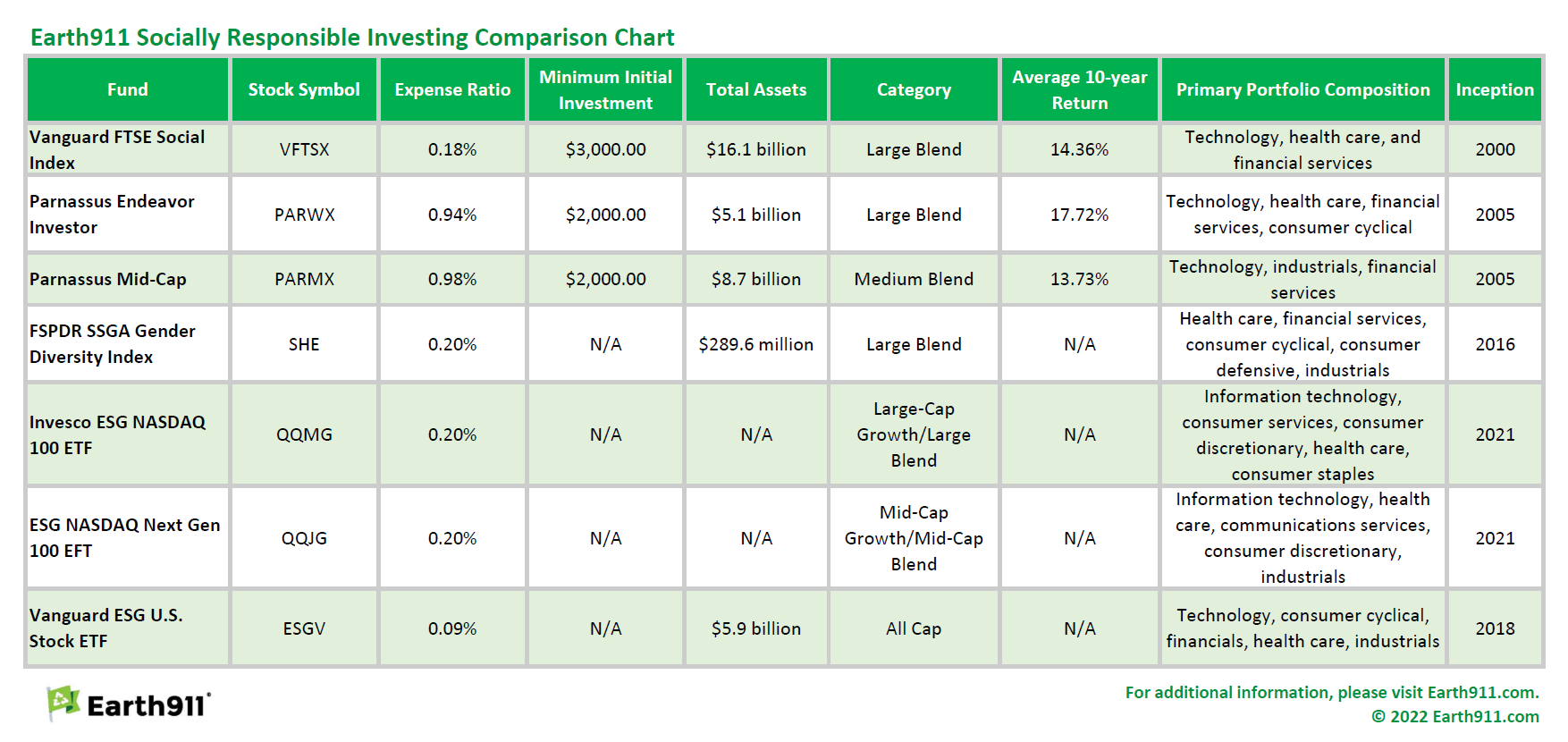

7 Great Low-Fee Socially Responsible Investment Funds

Earth911 picked the next funds, however these are simply seven out of many socially accountable funds out there. Please assessment any funds fastidiously earlier than you make investments, and ensure they align along with your values and monetary targets. Remember, whatever the fund, there may be an inherent threat in investing in mutual funds and ETFs.

Parnassus Endeavor Investor (PARWX)

Parnassus Investments was based in 1984 earlier than most individuals thought of socially accountable investing. Founder Jerome Dodson believed that there’s a decrease funding threat when eliminating corporations concerned in alcohol, playing, and tobacco and as a substitute, investing in corporations which might be conscious of the setting and workers. Also, this huge firm progress fund eliminates fossil gas corporations and seeks companies with wonderful working environments.

Parnassus Mid-Cap (PARMX)

This Parnassus fund invests in mid-sized corporations and focuses on fast-growing corporations. Parnassus Mid-Cap is much less strict than the Endeavor Investor and does permit fossil-fuel corporations. The portfolio consists of fewer than 40 shares and has a below-average turnover.

SPDR SSGA Gender Diversity Index (SHE)

This new exchange-traded fund was began in 2016 and consists of U.S. large-cap corporations. The fund is a good way to put money into women-led companies, because the fund seeks corporations with higher gender variety in senior administration and on boards. After charges, the fund efficiency typically follows the SSGA Gender Diversity Index.

Vanguard FTSE Social Index Fund Investor Shares (VFTSX)

The index fund has alcohol, tobacco, and pornography screens and likewise eliminates corporations concerned in nuclear vitality or which have main gross sales to the navy. The fund additionally appears to be like for corporations that exhibit variety within the office and it eliminates corporations with human rights violations and main destructive environmental impacts.

Invesco ESG NASDAQ 100 ETF (QQMG)

Invesco recently rolled out two socially responsible ETFs, QQMG and QQJG, which should meet Nasdaq’s ESG criteria. Thus, corporations concerned in alcohol, hashish, controversial weapons, playing, nuclear energy, oil, fuel, and tobacco are usually not eligible. The issuers should additionally meet the ten United Nations Global Compact (UNGC) principles associated to labor, corruption, human rights, and the setting and have a Sustainalytics score of lower than 40 on a 100-point scale for unmanaged ESG dangers.

QQMG relies on the Nasdaq 100 Index, which contains the most important 100 non-financial corporations listed on the Nasdaq. The fund is just like the Invesco NASDAQ 100 ETF (QQQM), however with an environmental and social filter that removes a number of shares and weighs the businesses barely in a different way.

ESG NASDAQ Next Gen 100 EFT (QQJG)

This ETF has shares that meet the identical standards as QQMG and makes use of the Nasdaq Next Generation 100 Index, which contains the most important non-financial corporations exterior the Nasdaq 100. It is just like Invesco’s NASDAQ Next Gen 100 ETF (QQQJ), however the prime holdings and weighing are a bit totally different. At its launch, 10 corporations from the Nasdaq Next Generation 100 Index have been excluded, together with 4 casinos and three pharmaceutical corporations. This fund is an efficient technique to achieve publicity to non-financial mid-cap corporations.

Vanguard ESG U.S. Stock ETF (ESGV)

This fund filters out some corporations within the alcohol, tobacco, pornography, weapons, fossil fuels, playing, and nuclear energy industries and tracks the efficiency of the FTSE US All Cap Choice Index. The fund accommodates small, medium, and large-cap shares and is properly diversified. ESGV excludes some corporations which have violations of labor rights, human rights, anti-corruption, and environmental requirements as outlined by UN Global Compact ideas, in addition to some variety necessities.

Comparison Chart

For a bigger model of our printable comparability chart, click on the picture beneath.

Originally printed on December 20, 2018, this text was up to date in January 2022.