Disclosure: As an Amazon Associate I earn from qualifying purchases. This page may contain affiliate links, which means I may receive a commission if you click a link and purchase something that I have recommended. There is no additional cost to you whatsoever.

Even although the price of a photo voltaic power system has plummeted within the final decade, putting in photo voltaic panels on your own home nonetheless requires a big upfront funding. After all, a house photo voltaic panel system prices roughly $16,000 to 20,000 with out power storage batteries. Thankfully, there’s a federal photo voltaic tax credit score that may scale back the overall system value by $4,000 or $5,000 for programs in that worth vary. The federal solar tax credit considerably boosts the return on funding of the photo voltaic system by decreasing the overall system value.

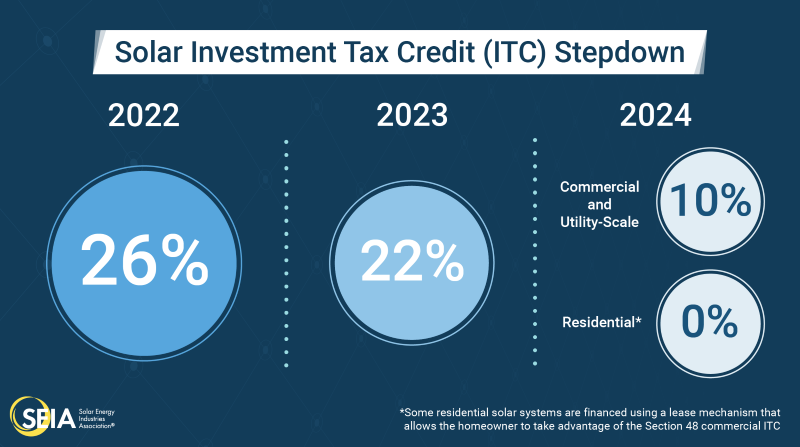

There is a 26% solar tax credit accessible for photo voltaic programs put in in 2022 and a 22% tax credit score for programs put in in 2023. Unfortunately, until prolonged, the photo voltaic tax credit score might be phased out solely for residential photo voltaic programs in 2024 and past. For industrial photo voltaic programs, the credit score will taper all the way down to 10% in 2024.

Let’s study the best way to apply the photo voltaic tax credit score and in the event you can profit from it.

What Is a Federal Tax Credit?

Tax credit are a dollar-for-dollar discount in income taxes owed to the federal authorities or Internal Revenue Service. For instance, a $4,500 tax credit score lowers your earnings tax legal responsibility by $4,500. However, the tax credit score has no worth to you you probably have no tax legal responsibility.

By distinction, a tax write-off or deduction lowers your whole taxable earnings, so it’s fairly totally different from a tax credit score. Unlike a tax credit score, the worth of a write-off relies on your tax fee. So, tax credit are extra priceless than a tax write-off of the identical quantity; a $4,500 tax credit score is price way more to you than a $4,500 tax write-off.

What Is the Federal Solar Tax Credit?

The federal authorities provides a photo voltaic tax credit score for residential and industrial photo voltaic panel programs. However, the tax credit score is simply accessible to the proprietor of the photo voltaic power system, so it doesn’t apply in the event you lease your system or enter into an influence buy settlement (PPA).

To qualify, it’s essential to set up the system on a major or secondary residence (for residential purposes), so renters, sadly, should not eligible. Also, the photo voltaic panels, inverter, and gear should be new. Therefore, used photo voltaic gear doesn’t qualify for the tax credit score.

The photo voltaic tax credit score is on the market for 26% of the overall system value in 2022, together with the solar panels, inverter, different gear, labor, and allowing prices. If the photo voltaic system is put in in 2023, the tax credit score is price 22% of the overall system value.

How Do I Apply the Federal Tax Credit?

It is essential to talk with a tax knowledgeable who understands your state of affairs to make sure you can benefit from the credit score.

If you qualify and you put in a photo voltaic system in 2022, you’ll be able to apply the tax credit score while you file your 2022 federal taxes. You might want to full IRS Form 5695 and fasten it to your federal tax return while you file your taxes. Because you apply the credit score in your tax return, you gained’t see the financial savings immediately; it isn’t a money rebate.

In addition, some states even have state photo voltaic tax credit that may be utilized when submitting your state earnings taxes. Refer to the DSIRE USA database by the NC Clean Energy Technology Center for data on native photo voltaic incentive packages, together with state property tax exemptions and utility rebate packages.

Are There Other Incentives for Installing Solar Panels?

Depending on the place you reside, a wide range of native photo voltaic incentives could also be accessible to you, together with utility firm packages and tax exemptions.

Solar Property Tax Exemptions

Studies show that properties with photo voltaic programs promote for extra. Your photo voltaic system will enhance your own home’s worth as a result of solar-powered properties have decrease utility payments. But a number of states have property tax exemptions to make sure that photo voltaic properties aren’t assessed for larger property taxes as a result of photo voltaic system.

In different phrases, putting in photo voltaic panels gained’t trigger your property taxes to extend in sure states, together with Arizona, Colorado, Connecticut, Florida, Texas, and Wisconsin.

Net Metering

If your utility firm provides internet metering, also referred to as internet power billing, you’re going to get credit in your electrical energy invoice for surplus energy you feed to the facility grid. Then while you want extra electrical energy than your panels are producing, maybe on a cloudy day or at night time, you’ll be able to offset this use together with your credit. Many states have internet metering legal guidelines requiring utility firms to supply this association.

Solar Sales Tax Exemption

Many states apply a tax for shopper purchases starting from 2.9% to 9.5%. However, there are at present 25 states that offer a solar energy sales tax exemption for going photo voltaic, together with Arizona, Florida, Iowa, Maryland, Massachusetts, New Mexico, and New York. This gross sales tax exemption applies to the price of the photo voltaic panels, inverter, battery financial institution, and set up.

Before putting in photo voltaic panels, it’s useful to know all of the photo voltaic incentives accessible, so you’ll be able to benefit from them. There could also be native photo voltaic insurance policies that may scale back the upfront value of putting in a photo voltaic system or create larger utility invoice financial savings.

Feature picture courtesy of Montgomery County Planning Commission (CC BY-SA 2.0)